Credit and Debit notes can be

created to amend over or under charged a Client after Invoice finalisation.

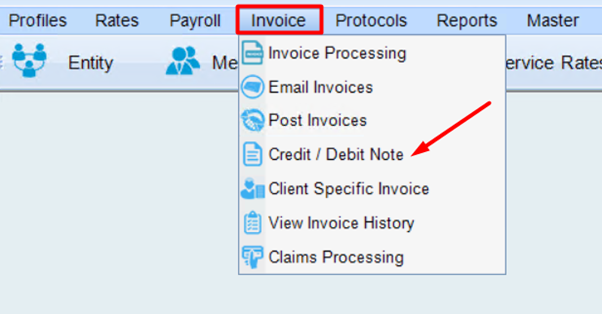

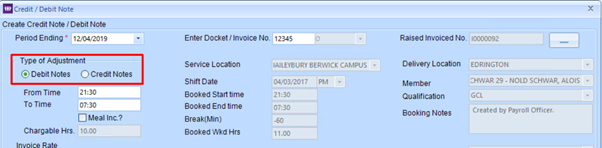

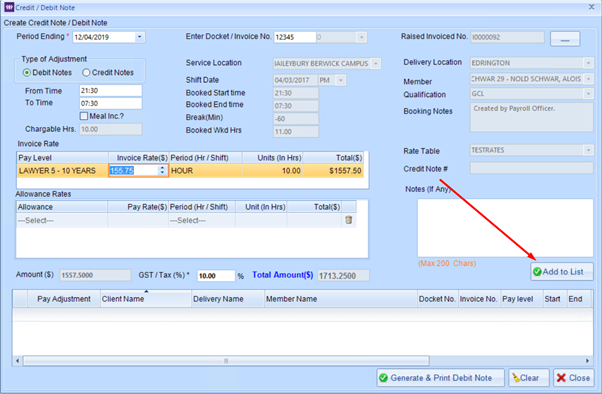

To create a Credit/ Debit note

please follow the below steps:

1. Select Invoice > Credit /

Debit Notes

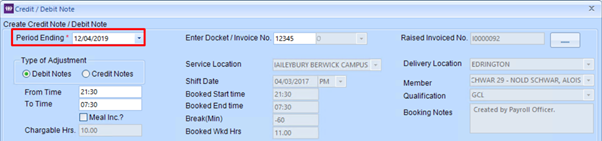

2. Select Period Ending Date

To be correctly calculated in the

export to your accounting software please ensure this is set for the next week

ending date to be processed and not the week ending of the original docket.

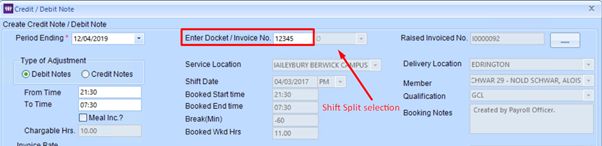

3. Enter Docket/Invoice Number

If the Credit/Debit applies to the

total invoice enter the invoice number. If it applies to a specific docket

please enter the docket number. If a Docket number is for a shift

that has a split the field on the right load the available parts to select the

component of the shift that the Credit/Debit note needs to be applied.

Once you have entered a docket

number or invoice number select Tab or click you mouse anywhere on the screen

to populate the matching data of the docket for ease of entry.

4. Select the Type of Adjustment

Credit - Is used when you have

overcharged client and wish to provide a credit to what customer owes.

Debit - Is used when you have

under charged the client and wish to formally request a credit note

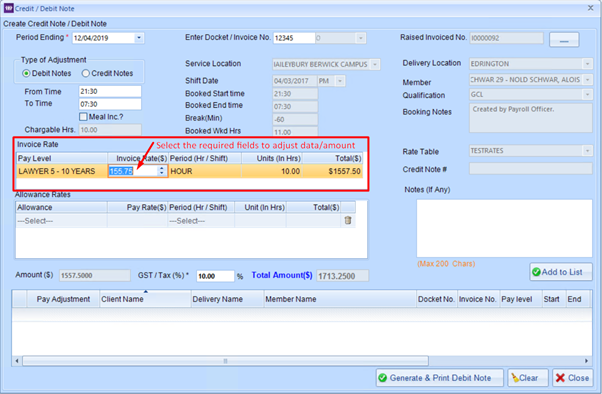

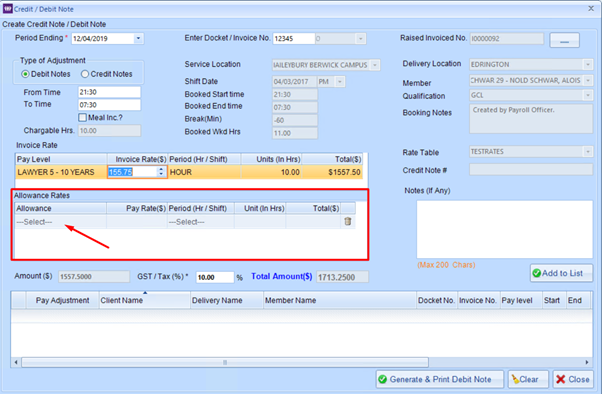

5. Make the Required adjustments.

This can be in

the invoice rate area for rates/hour changes or in the allowance area if it was an allowance change.

Please note what is set here will be added as a credit or debit against the invoice I.e. if you need to add a partial credit please enter the partial amount in this field, not the full invoiced amount.

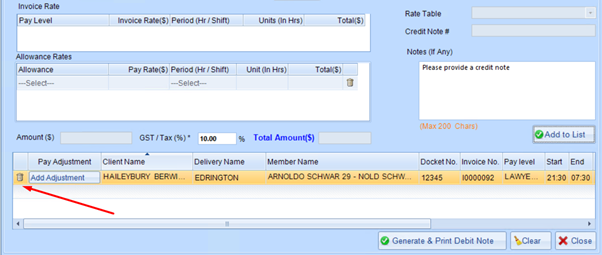

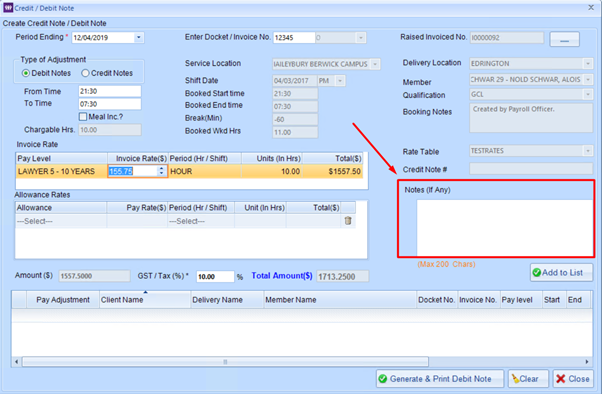

6. Add notes describing the adjustment

for the client to see on Credit/Debit note (optional)

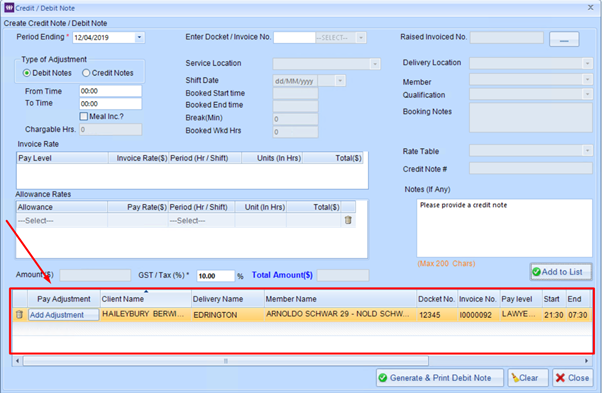

7. Select Add to list

Once Credit/Debit is added in

list you will see it appear below.

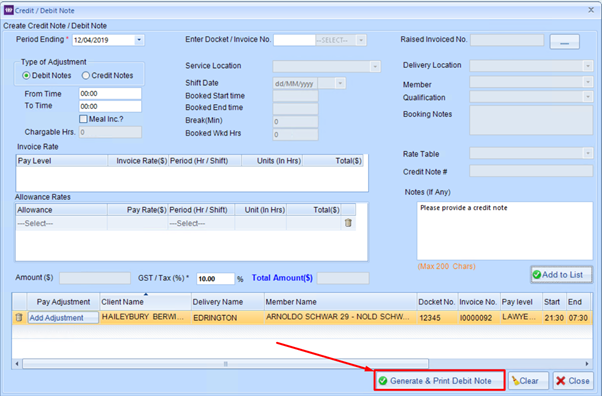

If you have other credit/debits notes to create

repeat steps. Once you are ready to finalise Credit/Debit notes select Generate

& Print Debit Note.

If you have incorrectly created a

a Credit/Debit note and have not generated it can be removed by selecting

the Rubbish Bin Icon in the far left corner.